Abstract

Institutions have a decisive impact on the prevalence and nature of entrepreneurship. To date, the impact of institutions on (productive) entrepreneurship and the effects of entrepreneurship on economic growth have largely been investigated in isolation. In this paper, we bring together institutions, entrepreneurship, and economic growth using a parsimonious growth model in a 3SLS specification. In our first stage, we regress multiple measures of entrepreneurial activity on institutional proxies that are known to correlate with more productive forms of entrepreneurial activity. Using the fitted values of this first-stage regression as our proxy for productive entrepreneurship, we can then estimate a panel growth regression following Islam (1995) in a second stage. The third stage then optimizes the estimation of the two equations simultaneously. Our results show that productive entrepreneurship contributes to economic growth. In our set of proxies for institutional quality, financial stability, small government, and perceived start-up skills are the most important predictors of such productive entrepreneurship.

Similar content being viewed by others

1 Introduction

In an entrepreneurial society (Audretsch 2007), institutions channel entrepreneurial talent towards productive entrepreneurship (Baumol 1990; Murphy et al. 1993). The term “productive entrepreneurship” refers to “any entrepreneurial activity that contributes directly or indirectly to net output of the economy or to the capacity to produce additional output” (Baumol 1993, p. 30). The entrepreneur then organizes available resources such as labor, finance, and knowledge to generate output. And here institutions determine if, how, and under what conditions entrepreneurs can get access to these inputs. Productive entrepreneurship includes entrepreneurship that generates innovation and ultimately, aggregate economic growth (Baumol 2010). The complex of interacting, multilevel institutions supporting productive entrepreneurship, recently labeled the Entrepreneurial Ecosystem (cf. Stam 2015; Acs et al. 2017), is notoriously hard to analyze empirically. Both productive entrepreneurship and institutional quality are concepts that are easier to define in theory than to accurately measure empirically. Nevertheless, empirical work relating entrepreneurship to institutions or economic growth to entrepreneurship is abundant and a broad range of proxies for both concepts have been used with mixed results and success. Based on a recent review of the literature, Bjørnskov and Foss (2016) concluded that most papers estimate straightforward models introducing proxies for entrepreneurship in cross-country and panel data models explaining GDP per capita, output per worker, or GDP per capita growth. Evidence on income levels and productivity suggests that a positive relation with entrepreneurship exists, but these analyses suffer from endogeneity issues and possibly publication bias. Moreover, there is very little evidence on the impact of entrepreneurship on growth. This lack of clear-cut empirical results can be linked to the complexity of the relationship that may play out differently in different contexts and with different lags (Carree and Thurik 2008; Stam and Van Stel 2011). At the same time, the empirical literature to date is often based on measures that are too broad—including all kinds of necessity and replicative entrepreneurship (Santarelli and Vivarelli 2007; Shane 2009)—or too narrow—excluding entrepreneurial behavior within organizations (Stam 2013; Foss and Lyngsie 2014). Moreover, Bjørnskov and Foss (2016) observe that studies tend to ignore the theoretically relevant ways in which firms and entrepreneurs moderate the relationship between institutions and aggregate economic performance. Short of collecting better primary data, there are broadly three ways to handle the lack of precise, internationally comparable measures of entrepreneurship.

First, Bruns et al. (2017) propose a latent class model, estimating the impact of broad measures of entrepreneurship on growth allowing for variation in the marginal effect of such entrepreneurship on growth across a finite number of classes. By using institutional quality indicators to predict the class distribution, they can then identify what institutions contribute to making entrepreneurship more productive. Second, Acs and Szerb (2009), Acs and Szerb (2016), and Acs et al. (2018) develop an integrated Global Entrepreneurship Index (GEI) in which institutional variables and indicators of entrepreneurial activity are combined using an algorithm that in the end assumes the link between institutions and entrepreneurship. The result is an institutional quality-adjusted index of entrepreneurship at the national (or regional) level. Third, there is the option to use 3SLS estimation models (see Urbano and Aparicio 2016) to estimate a system of equations in which productive entrepreneurship is estimated, instead of constructed as in the second option, or left latent as in the first option.

In this paper, we further explore this third option, essentially following a two-step procedure, from institutions to entrepreneurship, and then from entrepreneurship to economic growth. Specifically, we model economic growth following a standard panel growth regression model as in Islam (1995). We extend the panel growth regression model with productive entrepreneurship. Next, we estimate entrepreneurship as a function of institutional variables that are known to positively affect the productivity of entrepreneurship. A rigorous analysis of the relation between inputs (including institutional characteristics), outputs (types of entrepreneurial activity), and outcomes (economic growth) for 25 European countries between 2003 and 2014 yields support for a positive association between institutions and economic growth through productive entrepreneurship. In the context of European economies, ambitious growth oriented, opportunity-driven, and general independent entrepreneurial activities, to the extent that they are driven by institutional quality, are shown to be relevant for economic growth.Footnote 1

We test a range of institutional variables to cover the regulatory, cognitive, and normative dimensions of the institutional environment for entrepreneurs (Scott 1995). The regulatory dimension is most visible via the size of government intervention. It negatively affects the prevalence of opportunity- and growth-motivated independent entrepreneurial activity. The stability of the financial system positively affects the supply of opportunity-motivated independent entrepreneurship, and independent entrepreneurship in general. The cognitive dimension seems to be relevant to entrepreneurship in general. Perceived start-up skills positively affect independent entrepreneurial activity, but also opportunity- and growth-motivated independent entrepreneurial activity, and entrepreneurial employee activity. The normative dimension, measured by fear of failure and the value of entrepreneurship as a career choice, seems less relevant in the European context. Only the career choice positively relates to independent entrepreneurial activity in general, and opportunity-motivated independent entrepreneurial activity, and even negatively relates to the prevalence of growth-motivated entrepreneurial activity. Such activity then, in turn and to the extent that it is predicted by the various institutional variables, positively and strongly contributes to economic growth. That is, entrepreneurial activity is a proximate cause and should be modeled as the channel through which (the above) institutions contribute to economic growth. In the next section, we present the relevant background in a literature review. Building on this literature, we develop our empirical strategy in Sect. 3 and present our results in Sect. 4. Section 5 concludes.

2 Theoretical background and literature review

The field of institutional economics, with seminal contributions from North (1990), Scott (1995), and Williamson (2000), argues that formal (constitutions, laws, and regulations) and informal rules (norms, habits, social practices) play a key role in economic development. Recent studies on economic growth show that institutions are a fundamental cause of economic growth, shaping more proximate causes like the accumulation of physical and human capital (Hall and Jones 1999; Acemoglu et al. 2005). Baumol (1990) convincingly argued that institutions also drive the allocation of entrepreneurial talent in society. He clearly envisioned an integrated model in which institutions are the fundamental cause of growth, moderated through a proximate cause that is entrepreneurial activity. The literature, however, largely separates analyses of (a wide variety of) institutional variables on (many proxies for) entrepreneurship and another group linking (many proxies for) entrepreneurship to economic growth. We discuss these strands of literature in turn and bring them together in this paper.

2.1 Institutions and entrepreneurship

Authors, linking various measures of national institutions to various indicators of entrepreneurial activity, can usefully be structured along the regulatory, cognitive, and normative dimensions of institutions (Scott 1995; Busenitz et al. 2000). Table 1 summarizes the empirical literature along these dimensions.

The regulatory dimension of institutions consists of laws, regulations, and government policies. Examples include the regulation of finance, labor, and business (King and Levine 1993; Bjørnskov and Foss 2010; De Clercq et al. 2010; Levie and Autio 2011). Here it should be noted that less regulation is not necessarily positively correlated with (productive) entrepreneurship. As for example Darnihamedani et al. (this issue) show, higher start-up costs can prevent low-quality entrepreneurship, whereas higher corporate taxes do reduce the incentives to start innovative ventures. That result echoes Stenholm et al. (2013) who also found that indeed low entry barriers promote replicative but not high-impact entrepreneurship.Footnote 2

The cognitive dimension of institutions captures the knowledge and skills possessed by people pertaining to entrepreneurship. Within countries, particular issues and knowledge sets become institutionalized, and certain information becomes a part of a shared social knowledge. This includes the prevalence of knowledge to start a business within a society. Papers investigating the effect of such cognitive institutions on a variety of entrepreneurship indicators include Bowen and De Clercq (2008), Levie and Autio (2008), De Clercq et al. (2010), and Hafer and Jones (2014).

The normative dimension involves the degree to which people in society admire entrepreneurship, suffer from fear of failure, and consider independent start-up a legitimate career choice. Of course, such informal institutions are hard to measure consistently and precisely across countries. Still, papers linking indicators of such cultural attitudes to entrepreneurship include, e.g., De Clercq et al. (2010), Stephan and Uhlaner (2010), and Danis et al. (2011).

2.2 Entrepreneurship and economic growth

The three most prominent channels through which entrepreneurship may lead to economic growth are innovation creation, innovation diffusion, and competition (Wennekers and Thurik 1999). Innovation creation involves increasing variety by introducing new knowledge in the economy (Schumpeter 1934; Rosenberg 1992; Metcalfe 2004). Perhaps as important for increasing welfare is the diffusion of innovation by alert entrepreneurs seeing opportunities to fill gaps in the market (Kirzner 1997). Finally, there is the competition mechanism (Aghion et al. 2009; Fritsch and Changoluisa 2017). Table 2 provides a non-exhaustive overview of recent studies that have assessed the relationship between entrepreneurship and economic activity at the national level. The studies that focus on income and productivity levels typically find robust positive effects, but potentially suffer from endogeneity and reverse causality, among others, through the institutional quality channel. The much less prevalent studies on (per capita) income growth show more mixed results.

2.3 Institutions, entrepreneurship, and economic growth

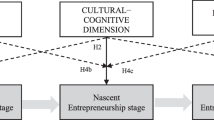

Unlike the papers discussed in this section, we believe it makes sense to analyze the interplay between institutions, entrepreneurship, and growth in a unified framework. In that way, one can use the structure we impose on the model to identify the impact that institutional quality has on growth by improving the quality of entrepreneurial activity. Figure 1 below gives a schematic illustration of the extended model we propose. In the lower part of the figure, we present the current state of the art in mainstream growth empirics, where institutions (as a fundamental cause) impact economic growth via the accumulation of production factors (as proximate causes). In the upper part, we extend the model by explicitly accounting for the role of entrepreneurship in a growth equation. We propose here to model entrepreneurship as a proximate cause and investigate how institutional quality, which has before been shown to associate with entrepreneurial activity, affects growth through such entrepreneurial activity. The only assumption we then need to impose is that indeed such institutional quality indicators affect growth (mainly) through their effect on entrepreneurial activity. As such, our approach can inform the construction of complex institutional quality-adjusted indices of entrepreneurial ecosystem quality as in Acs and Szerb (2009) and Acs et al. (2018), while going one step beyond the theoretically void latent class approach in, e.g., Bruns et al. (2017).

3 Empirical methodology and data

We develop our empirical strategy in four steps. First, we specify and estimate a standard growth model, for which we follow Islam (1995) and reproduce his findings as a solid baseline to work on. Second, we introduce different measures of entrepreneurship into this model directly. Under the assumption that institutions enable and constrain (productive) entrepreneurship in society, the third step is to estimate the relationship between (proxies for) institutional quality and entrepreneurial activity. In the fourth step, we then exploit the link between institutional quality and entrepreneurial activity to identify the impact of institutionally well-embedded entrepreneurship on economic growth. We do this by simultaneously estimating the effect of our proxies for institutional quality on our measures for entrepreneurial activity and on GDP per capita growth in a three-stage least squares (3SLS) specification. We first derive the model to be estimated more formally. Let the log GDP per capita in country i and year t be denoted by yit. The baseline model in conventional panel data notation is then given byFootnote 3

where sit represents the log saving rate, approximated by gross fixed capital formation over GDP; n and g equal the exogenous and constant growth rates of labor and technology, respectively; and δ is the constant depreciation rate. ηt represents time fixed effects, μi represents country fixed effects, and νit is the error term. For the second step of our procedure, we add different types of entrepreneurial activity, which are directly inserted into the model as

where \( {ent}_{it}^j \) denotes entrepreneurial activity indicator j for country i and year t.Footnote 4 This naive model, however, does not address the endogenous character of entrepreneurship and the dependence of its quality on the institutional context. Ignoring this endogeneity results in biased estimates of the coefficients in Eq. (2).

Therefore, we proceed, in the spirit of Aparicio et al. (2016) but aligning closely with the Islam (1995) model, to develop a system of two equations where entrepreneurial activity moderates the impact of a particular set of institutions (notably those that are expected to enhance productive entrepreneurship) on economic growth, controlling for the impact of the traditional input factors (see Eq. 3b, where k institutional variables are represented by \( {ins}_{it}^k \), along with m control variables \( {X}_{it}^m \) and φt represents time fixed effects).

We restrict our analysis to 25 of the current 28 European Union countries,Footnote 5 for which we have annual data available for the period 2003–2014. This time frame is not as extensive as used by others in economic growth modeling as we are constrained by the availability of our entrepreneurial activity indicators. For this reason, we chose to use annual data rather than 5-year averages as in Islam (1995).Footnote 6 This also implies, however, that more of the variation in GDP growth is related to the business cycle.Footnote 7

We take data on economic growth and capital formation from the Penn World Table (PWT) (Feenstra et al. 2015). Our dependent variable, Δyit, is defined as the first-differenced logarithm of expenditure-side real GDP per capita in Purchasing Power Parities (PPP). For the value of s, we take the logarithm of the share of gross capital formation in GDP. As our measure of n, we calculate the annual population growth rate. Following Mankiw et al. (1992), we set (g + δ) to be equal to 0.05 and assume this value to be the same for all countries and years in our sample. Finally, as our proxy for human capital we include the logarithm of the human capital index drawn from the PWT. This indicator is based on the average years of schooling (Barro and Lee 2013) and proxies for investment in “productive” human capital.

We include j = 4 alternative indicators for entrepreneurship \( {ent}_{it}^j \). Data have been obtained from the Global Entrepreneurship Monitor (GEM) (Reynolds et al. 2005; Bosma 2013). The first indicator ent1 denotes the prevalence rate of individuals who are actively involved in starting up a business, being either in the pre-start-up phase (having taken concrete steps to get the business started) or at most 42 months after the business started to generate income. This indicator is called Total Early-Stage Entrepreneurial Activity (TEA). It is important to note that this measure is treating all new independent economic activities equal. Opening a coffee shop or restaurant qualifies as TEA as much as starting Facebook or Spotify. Indicators ent2 and ent3 nuance TEA in terms of motivation (TEAopp = opportunity-motivated rather than necessity-motivated) for engaging in entrepreneurship and in terms of ambition (TEAgro = high growth expectations; specifically, entrepreneurs expecting to create five or more jobs in the coming 5 years), respectively. Indicator ent4, finally, denotes the rate of entrepreneurial employee activity (EEA): the prevalence rate of individuals who, as an employee, are actively involved in developing new products and services (see Bosma et al. 2013; Stam 2013).Footnote 8 Still, given their broad definitions, these indicators are likely to capture a rather broad range of activities with varying impacts on economic growth.

Our measures capturing the regulatory dimension of institutions are taken from the Fraser Institute Economic Freedom project.Footnote 9 We take three specific measures from this source, SGOV = “size of government,” REGB = “regulation of credit, labor, and business,” and FINS = “financial stability” (also known as “access to sound money”). Higher scores for SGOV indicate “small general government consumption,” “small transfer sector,” “few government enterprises,” and “low marginal tax rates and high-income thresholds.” Higher scores for REGB indicate “high percentage of deposits held in privately owned banks,” “low foreign bank license denial rate,” “private sector’s share of credit is close to the base-year-maximum,” “interest rates is determined primarily by market forces and the real rates are positive,” “low impact of minimum wage,” “no price controls or marketing boards,” and “starting a new business is generally easy.” Higher scores for FINS indicate “low annual money growth,” “low or no variation in the annual rate of inflation,” “low inflation rate,” and “foreign currency bank accounts are permissible without restrictions.” This variable largely captures macroeconomic financial stability, maintained by sound financial institutions, which are often considered to be an important precondition for economic development (Levine 1997). The scores are obtained from various sources, based on an assessment of existing rules and regulations in the different areas mentioned above. All scores range between 0 and 10.

Information on cognitive and normative elements of institutions were taken from the GEM. Concerning the cognitive elements, we include an element that relates specifically to entrepreneurship: SKIL = “perceived knowledge and skills to start a business.” SKIL is proxied by the percentage of the working age population who indicate that they “believe to have the required skills and knowledge to start a business,” as measured via the GEM Adult Population Surveys.Footnote 10

To cover the normative dimension we include FEAR = “fear of failure” and CARE = “entrepreneurship as a good career choice.” We measure FEAR as the percentage of individuals indicating that fear of failure would prevent them from setting up a business out of those that perceive that there are good opportunities to start a business in the area where they live. CARE denotes the percentage of the working-age population who believe that entrepreneurship is considered as a good career choice in their country.

In deriving the GEM-based measures at the national level from individual data, the observations have been weighted according to observed age and gender patterns in the countries (see Bosma 2013). Finally, we control for unemployment by including the rate of unemployment as percentage of total labor force. Descriptive statistics of variables that enter Eqs. 2 and 3a are shown in Table 3.Footnote 11 Correlations between independent variables are generally low, and multicollinearity issues are not present. Perhaps most interesting is that the EEA indicator appears to have the strongest positive correlations with the three performance indicators (1–3), and with the production factors (4–6).

Descriptive statistics of the variables that enter Eq. 3b (Table 4) also suggest no danger of multicollinearity. We observe that the variables expressing the regulatory dimension of institutions (SGOV, REGB, and FINS), the cognitive dimension (SKIL), and the normative dimension (FEAR, CARE) are positively associated with the more generic measures of entrepreneurship (TEA and TEAopp).

4 Results

Given our data availability, adopting annual data between 2003 and 2014 for 25 European countries, we first reproduce the panel data structure model introduced by Islam (1995). Bearing in mind the different time frame and set of countries, the estimates shown in Table 5 in model 1 compare rather well with those reported in Table 4 (22 OECD countries, 5-year periods) of Islam (1995). The estimated coefficient of the lagged dependent variable equals − 0.28 (this translates to 0.72 in Islam’s (1995) specification, where he found a coefficient of 0.59) and is significantly different from zero, suggesting convergence—all else being equal. The share of gross capital formation is also positively associated with economic growth around the steady state. We find a coefficient of 0.16, where Islam (1995) reports 0.12. The coefficient on population growth is, as in Islam (1995), not significant.Footnote 12 For human capital, we have taken a different variable, based on years of schooling (taken from Barro and Lee 2013) and assumed returns, and find a strong positive association with economic growth.

Adding different types of TEA to the equation in models 2a–2d, we observe that the more generic indicator of early-stage entrepreneurship, TEA, as well as the more specific ones, TEAopp and TEAgro, are marginally significant, whereas EEA is insignificant. Models 2a, 2b, and 2c do explain more of the data variance. One should note, however, that in model 2d we use a smaller sample due to more limited data availability. Based on the results in Table 5, a few observations can be made. First, we do find evidence for a positive association between the three TEA measures and GDP growth in our sample of European countries, over and above the impact of the traditional input factors. This is consistent with recent work like Aparicio et al. (2016) and Erken et al. (2016). However, the estimated size of the effect appears to be very limited: a 10% increase in a country’s TEA rate (which is realistic given the within-country variation) would, based on the results in model 2a, result in a mere 0.18% (note, not percent point) increase in GDP per capita growth. This may be statistically significant, but is an insignificant effect on the economy at large. Even in Europe, more restaurants and retail stores do not cause significant economic growth.

A second observation is that the variance of GDP growth in European countries explained by entrepreneurship picks up the modest part of the impact ascribed to human capital in model 1. Possibly this is because in Europe (the quality of), entrepreneurship is correlated with the overall educational level, whereas variance in entrepreneurial activity is higher than for educational attainment in our specific sample of countries. The other input factors seem far less affected. Thus, we may tentatively conclude that the impact of our measures for entrepreneurial activity on growth mostly links to human capital. Seeing entrepreneurship as a specific type of human capital has a long legacy in economics, going back to Marshall (1920) and Schultz (1975), we interpret this result as weakly supporting their intuition.

As shown in Fig. 1, however, our model is not complete at this stage: entrepreneurship is treated as an independent variable, while the literature described in the previous section strongly suggests it is not. We have not accounted for the institutional settings that provide the incentive structure for entrepreneurship. We do this in two steps: we first explain the country variation in entrepreneurship, by regressing our four indicators of entrepreneurship on our institutional variables. Second, we link these institutional variables to the growth equation by estimating an entrepreneurship and a growth equation in a simultaneous three-stage least squares (3SLS) panel data setting.

As a prelude to the 3SLS results, Table 6 presents the results of a linear model explaining national rates of entrepreneurial activity as measured by the TEA and EEA rates (i.e., Eq. 3b only). We included year dummies (φt) to account for business cycle effects that in our sample period are likely to dominate changes in institutional variables. Thus, the variance explained by institutional quality indicators is mainly identified across countries. We find that smaller “sizes” of government tend to go together with more entrepreneurial activity. The effect of the latter, however, is not significant for entrepreneurial employee activity (EEA). This makes sense, as a larger presence of government in economic activities, and the safety nets associated with it, are not expected to discourage EEA per se. Total early-stage entrepreneurial activity (TEA), opportunity-driven entrepreneurial activity (TEAopp), and growth-oriented entrepreneurial activity (TEAgro) seem to positively associate with financial stability (FINS). We should be careful interpreting these results, however, in a sample that was severely affected by the financial crisis.

The generally perceived ability and knowledge to start a business (SKIL) correlates strongly with observed entrepreneurship rates. Apparently self-efficacy is an important element of national institutional settings, regardless of whether this would be in starting a business or becoming active as an entrepreneur within the boundaries of an already existing firm.

Considering the effect of institutional structures, TEA rates have been structurally higher since 2011. Further analysis should demonstrate if this is due to a (post)economic crisis effect, or for example, to a higher presence of Eastern European countries in the sample (which may not be fully reflected by the institutional variables). In our regressions, such level shifts are absorbed in the year dummies. The variance explained is within the acceptable range given results from other studies summarized in Table 1. Various other variables have been included in alternative specifications. These did not appear to increase the model fit and/or result in multicollinearity issues.Footnote 13

We opted to include the broadest measure of entrepreneurial activity, overall TEA, in our 3SLS approach to capture most of the institutional quality induced productive entrepreneurship. Table 7 presents the results from the 3SLS procedure and shows that the effects of lagged GDP and share of gross capital formation are very similar to those in Table 5. Replacing crude TEA by the fitted values from the first-stage entrepreneurship regression, \( \widehat{TEA} \), however, changes the picture for the influence of (fitted) entrepreneurship and human capital. The part of entrepreneurial activity that results from better underlying institutions, \( \widehat{TEA} \), is positively associated with economic growth. Model 3c introduces the normative and cognitive dimensions of institutions and demonstrates the importance of societies that express high levels of perceived skills to start a business.

The results in Table 7 show that our proxies for the regulatory and cognitive institutional aspects of the entrepreneurial ecosystem operate on economic growth by improving the quality of total entrepreneurial activity. The coefficient on \( \overset{\wedge }{TEA} \) is (an order of magnitude) larger than the coefficient on TEA in Table 5, implying that the contribution of entrepreneurial activity that is predicted by aspects of the institutional environment is much bigger than the contribution of broad total entrepreneurial activity. Together, this supports the hypothesis that entrepreneurship is a proximate while institutional quality is a fundamental cause of economic growth. Our results confirm results in, e.g., Stenholm et al. (2013) and many others, who have shown that not all entrepreneurship is equally innovative or productive. At the same time, our results also confirm the importance of entrepreneurial activity as an important proximate cause of economic growth (Acs et al. 2009; Acs and Sanders 2013).

As a robustness check, we also adopted a GMM technique, following Caselli et al. (1996) who applied this technique to the data used by Islam (1995).Footnote 14 Our main results appear to be robust to adopting this alternative specification. The appendix (Online Resource) also includes the results of auxiliary 3SLS regressions, where TEAopp and TEAgro are taken as entrepreneurship indicators and where our institutional proxies are modeled to also impact the traditional input factors, in line with the dashed arrow in Fig. 1.

We also tested for the economic significance of the moderation effects represented by the institutional settings impacting economic growth through entrepreneurship. For the regulation of credit, labor and business, and the size of government, as well as the perceived skills to start a business among the population, we found statistically significant effects (p < .05). Improving each of these institutional components by 10% is estimated to lead to an increase in the growth of GDP per capita by about 1% point, respectively.Footnote 15 However, one should bear in mind that changing institutions (or rather the variables representing them in our data) by 10% is a very ambitious goal that usually requires multiple years of consistent and serious commitment towards improving the institutional structure.Footnote 16

Regarding the cognitive dimension of institutions, we estimated the moderation effects for the single significant variable in the entrepreneurship equation: the degree to which individuals in society perceive to have the skills to start a business (SKIL). This variable arguably includes two dimensions: awareness of what entrepreneurship entails and self-efficacy. Increasing this rate by 10% (which is a realistic assumption given observed variation between countries) would increase growth in GDP per capita with 0.5% points via more productive entrepreneurship. Thus, nurturing a culture of entrepreneurship that stimulates awareness and perceived capabilities can have a significant positive effect on GDP per capita growth through promoting productive entrepreneurial activity.

5 Conclusions

In this paper, we have tested to what extent and how institutional quality drives productive entrepreneurship that in turn promotes economic growth. With this we obtained improved estimates of the impact of entrepreneurship enhancing institutions on economic growth. To do so, we first augmented the well-established model of Islam (1995) and included various measures of entrepreneurial activity in the panel regressions for a sample of 25 European countries covering 2003–2014. Based on the existing literature on institutions and entrepreneurship, we identified relevant indicators fitting each of the three components identified by Scott (1995): regulative, cognitive, and normative. As for the regulative component, we showed that the regulation of credit, labor, and business is positively—while the size of the government is negatively—related to entrepreneurial activity. Concerning the cognitive element, nurturing a culture of entrepreneurship that stimulates awareness and perceived capabilities was found to be conducive to entrepreneurial activity. And we found a positive link between these institutional variables and GDP per capita growth that operates through all types of entrepreneurial activity. A robustness check, adopting Caselli et al. (1996) proposed econometric technique (GMM-sys) for dealing with panel data structures and one where we also allow the institutional variables under investigation to operate through factor accumulation, corroborate our main findings.

In fact, by explicitly taking the entrepreneurial channel for institutional quality into account, the variation in national economic growth explained increased, whereas the importance of human capital was shown to diminish. In terms of directions for policy, this combination of findings potentially signals that education should not only be directed towards cognitive skills, but also towards recognizing (business) opportunities and challenges, as well as teaching approaches to evaluate and exploit such opportunities and challenges. Greater attention to such soft and hard skills, possibly starting from primary education, would raise the awareness and appreciation of individuals’ own skills and knowledge required for (productive) entrepreneurship. This, paired with regulations around credit, labor, and business regulation that is “friendly” for entrepreneurs, increases per capita income growth. Given our results, increasing the perceived skills by 10% could result in an increase in GDP per capita growth of 0.5% points and improving the regulations around credit, labor, and business by 10% could result in additional growth of 1.1% points. Increasing these institutional scores by 10% is certainly not trivial and will require a sustained and targeted institutional reform strategy. Moreover, before one would start such an undertaking, many more institutional variables and proxies for entrepreneurial activity might be tried and tested using our proposed approach, to verify that we have identified the most relevant ones.Footnote 17 But the rewards are certainly worth the effort.

Our paper does not pretend to unravel all the mysteries of economic growth. A promising direction to do so understands the economy as a complex system (Beinhocker 2006; Arthur 2013), in which entrepreneurs are key agents who drive the creation of new organizational arrangements, technologies, and institutions, to better solve problems in society. In this article, we do show that economic growth models can be significantly improved in that direction, by considering institutional quality and entrepreneurial activity together. This builds on, and might further improve, the emerging literature on entrepreneurial ecosystems (Stam 2015; Acs et al. 2017), where empirical analysis is difficult, but essential. In addition, we propose a method for identifying the most relevant institutions that operate through entrepreneurial activity, broadly defined, on GDP per capita growth. This paper provides input that will help develop more quality-adjusted measures of entrepreneurship (e.g., Acs and Szerb 2009; Acs et al. 2014; Acs et al. 2018) and informs the latent class approach (Bruns et al. 2017) about the institutional variables that may predict entrepreneurial growth regimes.

Notes

In our analyses, we have used a range of proxies for entrepreneurship, from the very broad Total Entrepreneurial Activity (TEA) to the much more narrowly defined Entrepreneurial Employee Activity (EEA). We do not claim that these proxies measure productive entrepreneurship, but they serve as the dependent variable in our first-stage regression. Using broad, more noisy measures for entrepreneurial activity in this first stage biases our coefficients to zero and inflates our standard errors, such that our model is less likely to produce significant results. In that sense, the noisier is our measure of entrepreneurship, the more conservatively we test our main hypothesis of interest. Also note that we necessarily test only a limited set of institutional quality indicators. Again, these variables do not measure but only proxy for institutional quality. We shall refer to the theoretical concepts “institutions” and “institutional quality” in the Sects. 1 and .2. In Sect. 4, we take care to be more precise.

They also show it is “conducive” institutions (e.g., R&D intensity and patenting) that will drive productive, innovative entrepreneurship. In their paper, as in Darnihamedani et al. (this issue), however, the authors take predefined (and self-reported) GEM measures of innovative entrepreneurship as their dependent variables under the implicit assumption that the self-assessed high-impact entrepreneurs indeed contribute to economic growth. In this paper, we take GDP per capita growth and estimate the impact of institutionally driven entrepreneurial activity. In such an approach, it is more useful to have broader, more general measures of both institutional quality and entrepreneurial activity. See footnote 1.

Cf. Islam (1995) Equation (12).

Note that, when introduced in this way, we implicitly assume entrepreneurship is related to the rate at which countries converge on their respective steady states. Given the panel specification, moreover, country and time fixed effects in convergence speed have been cleaned out.

Omitted EU-28 countries are Bulgaria, Cyprus, and Malta. UK is included.

In our Appendix (Online Resource), we describe the results of a generalized method of moments (GMM-SYS) technique as a check for robustness. In one of the specifications, we adopt a 3-year average setup. Results remain qualitatively similar.

Given the fact that our period includes the financial crisis of 2007–2011 that affected most European member states substantially, this should be duly considered when interpreting the results. The financial crisis can be expected to obscure the hypothesized, long-run relationships between institutions, entrepreneurship, and economic growth. That is, as demand-side economic shocks dominate observed economic growth, the relationship between these variables from the supply side will be harder to discern. This would bias our coefficients towards zero and again bias our results against finding support for the hypothesis that entrepreneurship improving institutions affect economic growth. As such, it implies that our test is conservative. Alternatively, one could interpret our model as a test of the hypothesis that institutionally embedded entrepreneurship helps moderate and absorb negative demand-side shocks (as opposed to creating long term growth). Either way, the analyses can reveal useful insights on the relation between institutions, entrepreneurship, and economic growth.

The EEA measure was introduced in the GEM survey only in 2011 and has been adopted systematically only since 2014.

It should be acknowledged that this measure may encompass different elements: it may reflect (subjective) skills, the difficulty of starting a business (minimum capabilities needed) in each context, and even the awareness of the difficulty or easiness of starting a business. In some contexts, it may also reflect “overconfidence” on the aggregate level.

Here, variables 2 (GDP per capita growth rates) and 3 (labor productivity growth) represent alternative measures of economic performance. Models explaining these performance measures have been analyzed as a check for robustness—available from the authors upon request.

This can be explained by rather low variance in this variable in our sample.

Measures that entered the regression included corruption, associational activity, trust and informal investments. Including these measures either led to insignificant results, multicollinearity issues, and/or a significant loss in the number of observations. The variables included in the final model were chosen based on alignment with the literature and yielding an acceptable number of observations in our country-year data structure.

The rationale (exploiting the dynamic nature of the panel structure), limitations (no explicit account of the effect of institutional quality on entrepreneurial activity), and results are discussed in the material given in the Online Resource.

The ln \( \overset{\wedge }{\mathrm{TEA}} \) coefficient in the growth equation then equals 0.11, while the coefficients for ln business regulations and ln government size (in the entrepreneurship equation on ln TEA) equal 1.0 and 0.8, respectively. This implies that for a 10% increase in these institutional quality indicators, the effect on ∆lny is 10%*{1.0, 0.8}*0.11 = {0.011, 0.008} or about 1% point higher growth, which, relative to an average growth of 0.02 with standard deviation 0.04 (see Table 3) is highly significant.

Indicators range from 0 to 10; however, we observe limited variation in the indicators over time: absolute averages of changes in a 5-year period equals to 0.33 for the regulation variable, with a maximum of 1.75. The average value of this indicator equals 7.2. Hence, in a 5-year period the average (absolute) change equals 4.5%.

High on the agenda for future research, for example, would be to test the proxies for institutional quality that make up the institutional component of the GEI index in Acs et al. (2018) and the variables tested in Stenholm et al. (2013), which seem more correlated with self-reported high impact entrepreneurship.

References

Acemoglu, D., Johnson, S., & Robinson, J. A. (2005). Institutions as a fundamental cause of long-run growth. Handbook of Economic Growth, 1, 385–472. https://doi.org/10.1016/S1574-0684(05)01006-3.

Acs, Z. J., & Sanders, M. W. (2013). Knowledge spillover entrepreneurship in an endogenous growth model. Small Business Economics, 41(4), 775–795. https://doi.org/10.1007/s11187-013-9506-8.

Acs, Z. J., & Szerb, L. (2009). The Global Entrepreneurship Index (GEINDEX). Foundations and Trends® in Entrepreneurship, 5(5), 341–435. https://doi.org/10.1561/0300000027.

Acs, Z. J., & Szerb, L. (2016). Extension of GEDI indicators. FIRES-report D4.1. http://www.projectfires.eu/wp-content/uploads/2016/03/D4.1-Report-on-Extention-of-the-GEDI-indicator.pdf

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. https://doi.org/10.1007/s11187-008-9157-3.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(3), 476–494. https://doi.org/10.1016/j.respol.2013.08.016.

Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10. https://doi.org/10.1007/s11187-017-9864-8.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics and economic growth: an ecosystem perspective. This issue.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. The Review of Economics and Statistics, 91(1), 20–32. https://doi.org/10.3386/w12027.

Aidis, R., Estrin, S., & Mickiewicz, T. M. (2012). Size matters: entrepreneurial entry and government. Small Business Economics, 39(1), 119–139. https://doi.org/10.1007/s11187-010-9299-y.

Aparicio, S., Urbano, D., & Audretsch, D. (2016). Institutional factors, opportunity entrepreneurship and economic growth: panel data evidence. Technological Forecasting and Social Change, 102, 45–61. https://doi.org/10.1016/j.techfore.2015.04.006.

Arthur, W. B. (2013). Complexity economics: a different framework for economic thought. Santa Fe Institute Working Paper.

Audretsch, D. B. (2007). The entrepreneurial society. Oxford: Oxford University Press.

Barro, R. J., & Lee, J. W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of Development Economics, 104, 184–198. https://doi.org/10.1016/j.jdeveco.2012.10.001.

Baumol, W. J. (1990). Entrepreneurship: productive, unproductive and destructive. Journal of Political Economy, 98, 893–921. https://doi.org/10.1016/0883-9026(94)00014-X.

Baumol, W. J. (1993). Entrepreneurship, management and the structure of payoffs. London: MIT Press. https://doi.org/10.1080/08109029508629199.

Baumol, W. J. (2010). The microtheory of innovative entrepreneurship. Princeton: Princeton University Press.

Beinhocker, E. D. (2006). The origin of wealth: evolution, complexity, and the radical remaking of economics. Boston: Harvard Business Press.

Bjørnskov, C., & Foss, N. J. (2008). Economic freedom and entrepreneurial activity: some cross country evidence. Public Choice, 134(3–4), 307–328. https://doi.org/10.1007/s11127-007-9229-y.

Bjørnskov, C., & Foss, N. (2010). Economic freedom and entrepreneurial activity: some cross-country evidence. In A. Freytag & R. Thurik (Eds.), Entrepreneurship and Culture (pp. 201–225). Berlin Heidelberg: Springer. https://doi.org/10.1007/978-3-540-87910-7_10.

Bjørnskov, C., & Foss, N. (2013). How strategic entrepreneurship and the institutional context drive economic growth. Strategic Entrepreneurship Journal, 7(1), 50–69. https://doi.org/10.1002/sej.1148.

Bjørnskov, C., & Foss, N. J. (2016). Institutions, entrepreneurship, and economic growth: what do we know and what do we still need to know? The Academy of Management Perspectives, 30(3), 292–315. https://doi.org/10.5465/amp.2015.0135.

Bosma, N. (2013). The Global Entrepreneurship Monitor (GEM) and its impact on entrepreneurship research. Foundations and Trends® in Entrepreneurship, 9(2), 143-248. https://doi.org/10.1561/0300000033.

Bosma, N., Wennekers, S., Guerrero, M., Amorós, J. E., Martiarena, A., & Singer, S. (2013). The Global Entrepreneurship Monitor. Special report on entrepreneurial employee activity. London: GERA.

Bowen, H. P., & De Clercq, D. (2008). Institutional context and the allocation of entrepreneurial effort. Journal of International Business Studies, 39(4), 747–767. https://doi.org/10.1057/palgrave.jibs.8400343.

Braunerhjelm, P., Acs, Z. J., Audretsch, D. B., & Carlsson, B. (2010). The missing link: knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125. https://doi.org/10.1007/s11187-009-9235-1.

Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: a regional cross-section growth regression approach. Small Business Economics, 49(1), 31–54. https://doi.org/10.1007/s11187-017-9866-6.

Busenitz, L. W., Gomez, C., & Spencer, J. W. (2000). Country institutional profiles: unlocking entrepreneurial phenomena. Academy of Management Journal, 43(5), 994–1003. https://doi.org/10.2307/1556423.

Carree, M. A., & Thurik, A. R. (2008). The lag structure of the impact of business ownership on economic performance in OECD countries. Small Business Economics, 30(1), 101–110. https://doi.org/10.1007/s11187-006-9007-0.

Carree, M., Van Stel, A., Thurik, R., & Wennekers, S. (2007). The relationship between economic development and business ownership revisited. Entrepreneurship & Regional Development, 19(3), 281–291. https://doi.org/10.1080/08985620701296318.

Caselli, F., Esquivel, G., & Lefort, F. (1996). Reopening the convergence debate: a new look at cross-country growth empirics. Journal of Economic Growth, 1(3), 363–389. https://doi.org/10.1007/BF00141044.

Castaño-Martínez, M. S., Méndez-Picazo, M. T., & Galindo-Martín, M. Á. (2015). Policies to promote entrepreneurial activity and economic performance. Management Decision, 53(9), 2073–2087. https://doi.org/10.1108/MD-06-2014-0393.

Danis, W. M., De Clercq, D., & Petricevic, O. (2011). Are social networks more important for new business activity in emerging than developed economies? An empirical extension. International Business Review, 20(4), 394–408. https://doi.org/10.1016/j.ibusrev.2010.08.005.

De Clercq, D., Danis, W. M., & Dakhli, M. (2010). The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review, 19(1), 85–101. https://doi.org/10.1016/j.ibusrev.2009.09.002.

Erken, H., Donselaar, P., & Thurik, R. (2016). Total factor productivity and the role of entrepreneurship. The Journal of Technology Transfer, 1-29. https://doi.org/10.1007/s10961-016-9504-5.

Feenstra, R. C., Inklaar, R., & Timmer, M. P. (2015). The next generation of the Penn world table. American Economic Review, 105(10), 3150–3182. https://doi.org/10.1257/aer.20130954 available for download at www.ggdc.net/pwt.

Foss, N. J., & Lyngsie, J. (2014). The strategic organization of the entrepreneurial established firm. Strategic Organization, 12(3), 208–215. https://doi.org/10.1177/1476127014543262.

Fritsch, M., & Changoluisa, J. (2017). New business formation and the productivity of manufacturing incumbents: effects and mechanisms. Journal of Business Venturing, 32(3), 237–259. https://doi.org/10.1016/j.jbusvent.2017.01.004.

Hafer, R. W., & Jones, G. (2014). Are entrepreneurship and cognitive skills related? Some international evidence. Small Business Economics, 44(2), 283–298. https://doi.org/10.1007/s11187-014-9596-y.

Hall, R. E., & Jones, C. I. (1999). Why do some countries produce so much more output per worker than others? The Quarterly Journal of Economics, 114(1), 83–116. https://doi.org/10.1162/003355399555954.

Hessels, J., & Van Stel, A. (2011). Entrepreneurship, export orientation, and economic growth. Small Business Economics, 37(2), 255–268. https://doi.org/10.1007/s11187-009-9233-3.

Hessels, J., van Gelderen, M., & Thurik, R. (2008). Drivers of entrepreneurial aspirations at the country level: the role of start-up motivations and social security. International Entrepreneurship and Management Journal, 4(4), 401–417. https://doi.org/10.1007/s11365-008-0083-2.

Ho, Y. P., & Wong, P. K. (2007). Financing, regulatory costs and entrepreneurial propensity. Small Business Economics, 28(2), 187–204. https://doi.org/10.1007/s11187-006-9015-0.

Islam, N. (1995). Growth empirics: a panel data approach. The Quarterly Journal of Economics, 110(4), 1127–1170. https://doi.org/10.2307/2946651.

King, R. G., & Levine, R. (1993). Finance, entrepreneurship and growth. Journal of Monetary Economics, 32(3), 513–542. https://doi.org/10.1016/0304-3932(93)90028-E.

Kirzner, I. M. (1997). Entrepreneurial discovery and the competitive market process: an Austrian approach. Journal of Economic Literature, 35(1), 60–85 http://www.jstor.org/stable/2729693.

Lafuente, E., Szerb, L., & Acs, Z. J. (2016). Country level efficiency and National Systems of entrepreneurship: a data envelopment analysis approach. Journal of Technology Transfer, 41(6), 1260–1283. https://doi.org/10.1007/s10961-015-9440-9.

Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31(3), 235–263. https://doi.org/10.1007/s11187-008-9136-8.

Levie, J., & Autio, E. (2011). Regulatory burden, rule of law, and entry of strategic entrepreneurs: an international panel study. Journal of Management Studies, 48(6), 1392–1419. https://doi.org/10.1111/j.1467-6486.2010.01006.x.

Levine, R. (1997). Financial development and economic growth: views and agenda. Journal of Economic Literature, 35(2), 688–726 http://www.jstor.org/stable/2729790.

Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A contribution to the empirics of economic growth. The Quarterly Journal of Economics, 107(2), 407–437. https://doi.org/10.2307/2118477.

Marshall, A. (1920). Industry and trade: a study of industrial technique and business organization; and of their influences on the conditions of various classes and nations. Basingstoke: Macmillan.

Metcalfe, J. S. (2004). The entrepreneur and the style of modern economics. Journal of Evolutionary Economics, 14(2), 157–175. https://doi.org/10.1007/s00191-004-0210-3.

Murphy, K. M., Schleifer, A., & Vishny, R. W. (1993). Why is rent-seeking so costly to growth? American Economic Review. Papers and Proceedings, 83(2), 409–414 http://www.jstor.org/stable/2117699.

Nissan, E., Galindo, M. A., & Picazo, M. T. M. (2012). Innovation, progress, entrepreneurship and cultural aspects. International Entrepreneurship and Management Journal, 8(4), 411–420. https://doi.org/10.1007/s11365-012-0229-0.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

Pinillos, M. J., & Reyes, L. (2011). Relationship between individualist–collectivist culture and entrepreneurial activity: evidence from global entrepreneurship monitor data. Small Business Economics, 37(1), 23–37. https://doi.org/10.1007/s11187-009-9230-6.

Prieger, J. E., Bampoky, C., Blanco, L. R., & Liu, A. (2016). Economic growth and the optimal level of entrepreneurship. World Development, 82, 95–109. https://doi.org/10.1016/j.worlddev.2016.01.013.

Rarick, C., & Han, T. (2015). The role of culture in shaping an entrepreneurial mindset. International Journal of Entrepreneurship, 19, 119–125.

Reynolds, P., Bosma, N., Autio, E., Hunt, S., De Bono, N., Servais, I., & Chin, N. (2005). Global entrepreneurship monitor: data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231. https://doi.org/10.1007/s11187-005-1980-1.

Rosenberg, N. (1992). Economic experiments. Industrial and Corporate Change, 1(1), 181–203. https://doi.org/10.1093/icc/1.1.1.

Santarelli, E., & Vivarelli, M. (2007). Entrepreneurship and the process of firms’ entry, survival and growth. Industrial and Corporate Change, 16(3), 455–488. https://doi.org/10.1093/icc/dtm010.

Schultz, T. W. (1975). The value of the ability to deal with disequilibria. Journal of Economic Literature, 13(3), 827–846 http://www.jstor.org/stable/2722032.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge: Harvard University Press.

Scott, W. R. (1995). Institutions and organizations (Vol. 2). Thousand Oaks: Sage.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149. https://doi.org/10.1007/s11187-009-9215-5.

Stam, E. (2013). Knowledge and entrepreneurial employees: a country-level analysis. Small Business Economics, 41(4), 887–898. https://doi.org/10.1007/s11187-013-9511-y.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: a sympathetic critique. European Planning Studies, 23(9), 1759–1769. https://doi.org/10.1080/09654313.2015.1061484.

Stam, E., & Van Stel, A. (2011). Types of entrepreneurship and economic growth. In M. Goedhuys, W. Naudé, & E. Szirmai (Eds.), Innovation, entrepreneurship and economic development (pp. 78–95). Oxford: Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199596515.003.0004.

Stam, E., Hartog, C., Van Stel, A., & Thurik, R. (2011). Ambitious entrepreneurship, high-growth firms and macro-economic growth. In M. Minniti (Ed.), The dynamics of entrepreneurship. Evidence from the global entrepreneurship monitor data (pp. 231–249). Oxford: Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199580866.003.0011.

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28(1), 176–193. https://doi.org/10.1016/j.jbusvent.2011.11.002.

Stephan, U., & Uhlaner, L. M. (2010). Performance-based vs socially supportive culture: a cross-national study of descriptive norms and entrepreneurship. Journal of International Business Studies, 41(8), 1347–1364. https://doi.org/10.1057/jibs.2010.14.

Stephen, F., Urbano, D., & van Hemmen, S. (2009). The responsiveness of entrepreneurs to working time regulations. Small Business Economics, 32(3), 259–276. https://doi.org/10.1007/s11187-007-9096-4.

Urbano, D., & Aparicio, S. (2016). Entrepreneurship capital types and economic growth: international evidence. Technological Forecasting and Social Change, 102, 34–44. https://doi.org/10.1016/j.techfore.2015.02.018.

Van Stel, A., Storey, D. J., & Thurik, A. R. (2007). The effect of business regulations on nascent and young business entrepreneurship. Small Business Economics, 28(2), 171–186. https://doi.org/10.1007/s11187-006-9014-1.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13(1), 27–56. https://doi.org/10.1023/A:1008063200484.

Williamson, O. E. (2000). The new institutional economics: taking stock, looking ahead. Journal of Economic Literature, 38(3), 595–613. https://doi.org/10.1257/jel.38.3.595.

Acknowledgements

This project has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No. 649378, the FIRES-project (http://www.projectfires.eu/). We would like to thank participants in the FIRES-conference 4–6 October 2017, three anonymous reviewers, and the editors for their constructive suggestions.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 423 kb)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Bosma, N., Content, J., Sanders, M. et al. Institutions, entrepreneurship, and economic growth in Europe. Small Bus Econ 51, 483–499 (2018). https://doi.org/10.1007/s11187-018-0012-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-018-0012-x