Abstract

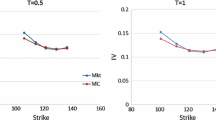

The prices of lots of assets have been proved in literature to exhibit special behaviors around psychological barriers, which is an important fact needed to be considered when pricing derivatives. In this paper, we discuss the valuation problem of double barrier options under a volatility regime-switching model where there exist psychological barriers in the prices of underlying assets. The volatility can shift between two regimes, that is to say, when the asset price rises up or falls down through the psychological barrier, the volatility takes two different values. Using the Laplace transform approach, we obtain the price of the double barrier knock-out call option as well as its delta. We also provide the eigenfunction expansion pricing formula and examine the effect of the psychological barrier on the option price and delta, finding that the gamma of the option is discontinuous at such barriers.

Similar content being viewed by others

Notes

Readers should not be confused by the two kinds of barriers with different meanings in “double barrier option” and “psychological barrier”.

We only find two previous papers that addressed discontinuous-coefficient diffusions for pricing purpose. One is Decamps et al. (2006) which used spectral expansion method to price interest rate derivatives in an economy subject to zero interest rate policy; the other is Gairat and Shcherbakov (2014) which provided the price formula for plain vanilla options grounded on the functionals of skew Brownian motions.

The finding indicates that the investor should take extra care of his hedging strategy when the underlying asset breaks through the psychological barrier, which is in accordance with the perspective in Pierdzioch (2001): “Thus, combing the results of the theoretical and the empirical analysis, financial institutions or economic agents participating in the trading of options on one or the other of the mentioned currencies should take care of implicit price barriers when it comes either to the pricing or to the hedging of positions involving these contracts”. Such requirement for adjusting hedging positions is also advocated in Jang et al. (2015).

We can suppose the price under the physical measure to be driven by

$$\begin{aligned} \frac{{\mathrm {d}}S_t}{S_t}=\mu \left( S_t-S^{*}\right) {\mathrm {d}}t+\sigma \left( S_t-S^{*}\right) {\mathrm {d}}B_t, \end{aligned}$$where

$$\begin{aligned} \mu (x) =\left\{ \begin{array}{ll} \displaystyle \mu _{1}> 0, &{} \quad x\ge 0,\\ \displaystyle \mu _{2}> 0, &{} \quad x< 0, \end{array} \right. \end{aligned}$$and the volatility function \(\sigma \) is of the form (2). The asymmetry in \(\mu \) consists with the market observation that the rates of return will change after the asset prices pass through psychological barriers as evidenced by Cyree et al. (1999) and Jang et al. (2015).

This limitation of the model is also pointed out by the authors in their paper.

Throughout this paper, we suppose that \(L \le S_{0}, K \le U\).

The symmetric local time for a continuous semimartingale \(Y_{t}\) is defined by

$$\begin{aligned} {L}^Y_{t}(x)=\lim _{\epsilon \rightarrow 0+}\frac{1}{2\epsilon }\int _{0}^{t}{\mathbbm {1}}_{\{|Y_s-x|\le \epsilon \}} {\mathrm {d}}\langle Y\rangle _{s}, \end{aligned}$$where \(\langle Y\rangle _{t}\) stands for the quadratic variation process of \(Y_{t}\). It is an increasing process and can be seen as an occupation time density. To see more details about this process, please refer to Philip (2004).

The Mathematica code for this algorithm is available at http://www.pe.tamu.edu/valko/public_html/Nil/.

Both of them can be implemented directly by using the built-in root-search function fzero and the numerical integration function quad in MATLAB 7.10, or FindRoot and NIntegrate in MATHEMATICA 8, respectively.

From the definitions of \(g_{1}\) and \(g_{2}\) in (2), it is straightforward to know that \({\mathbf {E}}[e^{-\lambda T_{L,U}}]=g_{1}(X_{0})+g_{1}(X_{0})\) where \(X_{0}=\log (S_{0}/S^{*})\), which indicates that we can use numerical Laplace inversion to get the exit probability.

References

Aggarwal, R., & Lucey, B. M. (2007). Psychological barriers in gold prices? Review of Financial Economics, 16(2), 217–230.

Bahng, S. (2003). Do psychological barriers exist in the stock price indices? Evidence from Asia’s emerging markets. International Area Studies Review, 6(1), 35–52.

Balduzzi, P., Foresi, S., & Hait, D. J. (1997). Price barriers and the dynamics of asset prices in equilibrium. Journal of Financial and Quantitative Analysis, 32(2), 137–159.

Boyle, P. P., & Tian, Y. (1998). An explicit finite difference approach to the pricing of barrier options. Applied Mathematical Finance, 5(1), 17–43.

Buchen, P., & Konstandatos, O. (2009). A new approach to pricing double-barrier options with arbitrary payoffs and exponential boundaries. Applied Mathematical Finance, 16(6), 497–515.

Cai, N., Chen, N., & Wan, X. (2009). Pricing double-barrier options under a flexible jump diffusion model. Operations Research Letters, 37(3), 163–167.

Campbell, J. Y., & Hentschel, L. (1992). No news is good news: An asymmetric model of changing volatility in stock returns. Journal of Financial Economics, 31(3), 281–318.

Chen, M. H., & Tai, V. W. (2011). Psychological barriers and prices behaviour of taifex futures. Global Economy and Finance Journal, 4(2), 1–12.

Chiarella, C., He, X. Z., Huang, W., & Zheng, H. (2012). Estimating behavioural heterogeneity under regime switching. Journal of Economic Behavior and Organization, 83(3), 446–460.

Cyree, K. B., Domian, D. L., Louton, D. A., & Yobaccio, E. J. (1999). Evidence of psychological barriers in the conditional moments of major world stock indices. Review of Financial Economics, 8(1), 73–91.

Davydov, D., & Linetsky, V. (2002). Structuring, pricing and hedging double-barrier step options. Journal of Computational Finance, 5(2), 55–88.

Davydov, D., & Linetsky, V. (2003). Pricing options on scalar diffusions: An eigenfunction expansion approach. Operations Research, 51(2), 185–209.

De Grauwe, P., & Decupere, D. (1992). Psychological barriers in the foreign exchange market. Journal of International and Comparative Economics, 1, 87–101.

Decamps, M., Goovaerts, M., & Schoutens, W. (2006). Self exciting threshold interest rates models. International Journal of Theoretical and Applied Finance, 9(7), 1093–1122.

Donaldson, R. G., & Kim, H. Y. (1993). Price barriers in the Dow Jones industrial average. Journal of Financial and Quantitative Analysis, 28(3), 313–330.

Dowling, M., Cummins, M., & Lucey, B. M. (2016). Psychological barriers in oil futures markets. Energy Economics, 53, 293–304.

Driessen, J., Lin, T. C., & Van Hemert, O. (2013). How the 52-week high and low affect option-implied volatilities and stock return moments. Review of Finance, 17(1), 369–401.

Eydeland, A., & Geman, H. (1995). Domino effect: Inverting the Laplace transform. Risk, 8, 65–67.

Faulhaber, O. (2002). Analytic methods for pricing double barrier options in the presence of stochastic volatility. Doctoral dissertation, Technische Universität Kaiserslautern.

Feng, L., & Linetsky, V. (2008). Pricing discretely monitored barrier options and defaultable bonds in Lévy process models: A fast Hilbert transform approach. Mathematical Finance, 18(3), 337–384.

Gairat, A., & Shcherbakov, V. (2014). Density of skew Brownian motion and its functionals with application in finance. Preprint. arXiv:1407.1715.

Gaver, D. P, Jr. (1966). Observing stochastic processes, and approximate transform inversion. Operations Research, 14(3), 444–459.

Geman, H., & Yor, M. (1996). Pricing and hedging double-barrier options: A probabilistic approach. Mathematical Finance, 6(4), 365–378.

Jang, B. G., Kim, C., Kim, K. T., Lee, S., & Shin, D. H. (2015). Psychological barriers and option pricing. Journal of Futures Markets, 35(1), 52–74.

Karlin, S., & Taylor, H. E. (1981). A second course in stochastic processes. New York: Academic.

Linetsky, V. (2004). The spectral decomposition of the option value. International Journal of Theoretical and Applied Finance, 7(3), 337–384.

Linetsky, V. (2007). Spectral methods in derivatives pricing. Handbooks in Operations Research and Management Science, 15, 223–299.

Mitchell, J., & Izan, H. Y. (2006). Clustering and psychological barriers in exchange rates. Journal of International Financial Markets, Institutions and Money, 16(4), 318–344.

Moon, K. S. (2008). Efficient Monte Carlo algorithm for pricing barrier options. Communications of the Korean Mathematical Society, 23(2), 285–294.

Narayan, P. K., & Narayan, S. (2014). Psychological oil price barrier and firm returns. Journal of Behavioral Finance, 15(4), 318–333.

Pelsser, A. (2000). Pricing double barrier options using Laplace transforms. Finance and Stochastics, 4(1), 95–104.

Pierdzioch, C. (2001). Noise trading, central bank interventions, and the informational content of foreign currency options (Vol. 313). Berlin: Springer.

Philip, P. (2004). Stochastic integration and differential equations. New York: Springer.

Revuz, D., & Yor, M. (1999). Continuous martingales and Brownian motion. New York: Springer.

Sepp, A. (2004). Analytical pricing of double-barrier options under a double-exponential jump diffusion process: Applications of Laplace transform. International Journal of Theoretical and Applied Finance, 7(2), 151–175.

Sonnemans, J. (2006). Price clustering and natural resistance points in the Dutch stock market: A natural experiment. European Economic Review, 50(8), 1937–1950.

Valko, P. P., & Abate, J. (2004). Comparison of sequence accelerators forthe Gaver method of numerical Laplace transform inversion. Computers and Mathematics with Applications, 48(3), 629–636.

Westerhoff, F. (2003). Anchoring and psychological barriers in foreign exchange markets. The Journal of Behavioral Finance, 4(2), 65–70.

Acknowledgements

The authors would like to thank the editors and the anonymous referee for their valuable comments and suggestions which helped to improve the paper significantly. This work was partially supported by the National Natural Science Foundation of China (No. 71532001).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Song, S., Wang, Y. Pricing double barrier options under a volatility regime-switching model with psychological barriers. Rev Deriv Res 20, 255–280 (2017). https://doi.org/10.1007/s11147-017-9130-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-017-9130-x

Keywords

- Double barrier option

- Psychological barrier

- Regime switching

- Laplace transform

- Delta

- Eigenfunction expansion