Abstract

Aim

Designing financial incentives for health behaviour change requires choices across several domains, including value (the size of the incentive), frequency of incentives, and direction (gain or loss). However, the rationale underlying complex incentive design is infrequently reported. Transparent reporting is important if we want to understand and improve the incentive development process. This paper describes a mixed methods approach for designing financial incentives for health behaviour change which involves stakeholders throughout the design process.

Subject and methods

The mixed methods approach focuses on incentives for weight loss for men with obesity living in areas with high levels of disadvantage. The approach involves: (a) using an existing framework to identify all domains of a financial incentive scheme for which choices need to be made, deciding what criteria are relevant (such as effectiveness, acceptability and uptake) and making choices on each domain on the basis of the criteria; (b) conducting a survey of target population preferences to inform choices for domains and to design the incentive scheme; and (c) making final decisions at a stakeholder consensus workshop.

Results

The approach was implemented and an incentive scheme for weight loss for men living with obesity was developed. Qualitative interview data from men receiving the incentives in a feasibility trial endorses our approach.

Conclusion

This paper demonstrates that a mixed methods approach with stakeholder involvement can be used to design financial incentives for health behaviour change such as weight loss.

Trial registration number

NCT03040518. Date: 2 February 2017.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Using personal financial incentives is one method to encourage individual health behaviour change and behaviour related outcomes such as smoking cessation, weight loss and increasing physical activity (Mantzari et al. 2015). Several systematic reviews of financial incentives highlight the potential for incentives to support individuals in their behaviour change (Mantzari et al. 2015, Mitchell et al. 2019, Coupe et al. 2019). Designing financial incentives is complex, as choices need to be made across several domains including magnitude (the size of the incentive), frequency, and direction (gain or loss) of the incentive. Nevertheless, most previous studies do not fully describe how the chosen incentive structure was developed for the target population (see, for example, (Patel et al. 2016, Yancy et al. 2018). Transparent reporting is important if we want to understand and improve the incentive development process (Duncan et al. 2020).

Financial incentives can vary in many domains, and a framework such as the one developed by (Adams et al. 2014) is useful for identifying all domains for which choices need to be made in a systematic way. It is important that intervention developers are transparent about their decision criteria, that is, the factors that were considered when making design choices. Effectiveness of the incentive in terms of supporting measured behaviour change can be informed by empirical evidence and theory such as behavioural economics. However, it is recognised that for the intervention to lead to meaningful population change, it is important that early in the process intervention developers consider all factors that might affect the use of the intervention in the real world (O'Cathain et al. 2019). It is important to consider uptake of the intervention and whether differential uptake may lead to an increase in health inequalities as, for example, more highly educated individuals may be more likely to engage with, and therefore benefit more from, health behaviour change interventions (Lorenc et al. 2013). Interventions also need to be practical, acceptable and sustainable, and to achieve this it is recommended that interventions are coproduced with stakeholders (National Institute for Health and Care Excellence (NICE) 2014). Involving stakeholders in developing interventions to improve health outcomes can increase their acceptability to the target population, service commissioners and providers (O'Cathain et al. 2019, Turner et al. 2019, Rousseau et al. 2019, Duncan et al. 2020).

This paper describes an inclusive approach for designing financial incentives for health behaviour change. It focuses on incentives for weight loss for men with obesity living in areas with high levels of disadvantage. The aim is to design financial incentives, co-produced with stakeholders, that are effective, optimise uptake, and are sustainable (when delivered in a real-world setting) and acceptable. This approach involves: (a) identifying the domains and the decision criteria to design a financial incentive scheme; (b) making initial choices on each domain based on the criteria (effectiveness, uptake, sustainability, and acceptability); (c) conducting a survey of target population preferences to inform the design of the incentive scheme; and (d) a stakeholder consensus workshop to make final decisions. Stakeholders are involved throughout the design process. As well as demonstrating the approach we also report qualitative interview data from men receiving the incentives in a feasibility trial to understand whether certain design aspects worked as intended.

Intervention design

The Games of Stones study (Dombrowski et al. 2020) aimed to engage men with obesity to lose weight through narrative text messages with or without financial incentives. The target population was adult men with obesity living in disadvantaged areas in Scotland, recruited through either general practice obesity registers or community outreach. The specific aim of the intervention was to support self-directed initial weight loss for the first 6 months, followed by a period of weight loss maintenance between 6 and 12 months to sustain clinical benefits of weight change. This period was chosen as maintenance of initial weight loss is generally poor (Dombrowski et al. 2014).

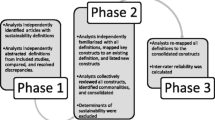

Figure 1 provides an overview of the intervention design process used. Continuous Patient and Public Involvement (PPI) was provided by a co-investigator partnership with the charities Men’s Health Forum GB and Men’s Health Forum in Ireland, and two independent lay members of the study steering committee. Throughout the study, researchers also met men (n = 6) on a one-to-one basis to discuss the incentive scheme and materials to ensure that these were appropriate and understandable.

I&II. Identifying the domains and decision criteria to design a financial incentive scheme

Financial incentives can vary in many domains. The framework by (Adams et al. 2014) was used to systematically identify all domains for which choices need to be made (Table 1). The domains are direction, form, magnitude, certainty, target, frequency, immediacy, schedule and recipient, and each contained several dimensions to choose from. The next stage is to identify the relevant decision criteria and make choices on each domain based on these criteria. The relevant decision criteria for the Games of Stones study were identified as:

-

effectiveness.

-

sustainability when delivered in a real-world setting: for the scheme to be sustainable it is important that it can be delivered at relatively low cost.

-

acceptability to the target population, public and service providers to inform design choices.

-

uptake and engagement.

III. Making initial design choice based on empirical evidence and theory

At the start of the study in 2016, initial design choices for the domains of the financial incentives were made by the Game of Stones co-investigators using the decision criteria above. Judgements about effectiveness, sustainability, acceptability and uptake were based on the best available evidence. The evidence was drawn from systematic reviews of interventions to help men with obesity (Robertson et al. 2014) and a systematic review of incentives for weight loss that was updated to identify new evidence (Paul-Ebhohimhen and Avenell 2008). Table 1 shows the initial design choices made at the start of the study.

Direction : evidence suggests that avoidance of penalty (such as deposit contracts) can be more effective than positive rewards in weight loss (Jeffery 2012). In a deposit contract, individuals deposit their own money into an account which will be returned to them if they achieve the target weight loss. However, they will lose the money if they do not follow through with their planned behaviour. This draws on insights from behavioural economics, namely loss aversion (Kahneman and Tversky 1979).

The use of deposit contracts may reduce uptake and engagement, particularly among disadvantaged groups, as participants are expected to deposit their own money. For example, (Halpern et al. 2016) found that individuals with higher incomes were more likely to accept a deposit contract for smoking cessation. Our scheme targeted men with obesity, particularly those living in areas of high disadvantage, many of whom could be faced with financial constraints. Therefore, rather than asking men to donate their own money, it was decided to use a ‘hypothetical’ endowment to try to invoke loss aversion. An endowment sum is pledged at the start of the scheme. Participants can then secure set values of the money at certain time points if they achieve a weight loss (which is paid out to them), but will ‘lose’ money if targets are unmet. Framing the incentives in terms of hypothetical losses is relatively novel. One previous study used a similar type of framing within a financial incentive scheme for physical activity (Patel et al. 2016). However, this study was within the workplace, where there is likely to be an implicit trust in terms of the endowment.

Form: money was chosen as the form of the incentive based on evidence that individuals prefer more flexible forms of payments (see (Hashemi et al. 2015)). We also explored men’s preferences for donating money to a charity rather than receiving cash, as part of the DCE survey (see below), as altruism is a recognised motivator for sustaining health behaviours.

Magnitude: the magnitude of the incentive needs to be large enough to be valued by participants, with larger incentive amounts preferred (Hashemi et al. 2015). However, larger incentives may be less acceptable to the general public (Giles et al. 2016) and potentially controversial, with individuals gaining financially for adopting or adapting health behaviours that others perform without financial recompense (Volpp et al. 2009). Selecting incentive amounts that had a cost equivalent to existing weight management services in 2016 (e.g. weight watchers or orlistat for a year) may improve acceptability of the intervention to the public, particularly if the incentives are shown to be effective (Promberger et al. 2012). There is considerable uncertainty in the literature around the magnitude of the incentive required for effectiveness and encouraging uptake. Further consideration was therefore required on this domain.

Certainty and target: the incentives were chosen to be certain (dependent on the achievement of pre-specified targets for weight loss (proxy measure for behaviours)) rather than lotteries. Lotteries are more difficult to organise, as they require a pool of participants. Certain payments (i.e. payments that are guaranteed) are also preferred to lotteries by participants (Marti et al. 2017) and the public (Giles et al. 2016). Weight loss can be objectively verified and easily measured in comparison to changes in behaviours such as diet and physical activity. Verified weight loss is likely to be important to service commissioners. At the time of study development, the minimum weight loss target for clinical benefit according to the UK National Institute for Clinical Excellence (NICE) was 3%, with 10% the highest target (NICE, 2014b). It is important to have a target that is high enough to motivate weight loss, but it was also recognised that a 10% target may be regarded as too challenging for some men and could lead to lower uptake and higher dropout rates. Given the uncertainty around the appropriate weight loss target, men’s preferences for weight targets were explored as part of the DCE survey.

Frequency, immediacy and schedule: Choice of frequency of incentives and a single payment at 12 months were largely informed by sustainability of this predominantly self-care digital intervention. Participants’ weights would be verified at four time points (baseline, 3, 6 and 12 months), mindful of PPI feedback about participant burden for appointment attendance, particularly for those with work, caring commitments or access issues, as well as sustainability if rolled out on a larger scale. Uncertainty remained around which of the 3, 6 and 12 month weight assessments to incentivise and how the incentive should be spread over the time points (Schedule). The specific aim of the intervention was to support self-directed initial weight loss for the first 6 months, followed by a period of weight loss maintenance between 6 and 12 months. It was therefore important to incentivise both initial weight loss (6 months and possibly 3 months) and maintenance (12 months). However, it was unclear how the incentive should be spread over these time points. Further consideration of frequency and schedule was therefore required and this was explored in the DCE (see 3.3).

Recipient: to ensure that the incentive scheme was sustainable, incentives were paid to individuals, as group weight loss targets are more difficult to organise, by direct bank transfer payments at 12 months only (the immediacy dimension). Whilst it is recognised that more immediate payments may be more effective (Vlaev et al. 2019), a one-off payment makes the incentive more sustainable and administratively less burdensome.

IV. Eliciting preferences of the target population

Designing the incentive scheme in line with the target group’s preferences can increase uptake and engagement. One particularly useful way to elicit the target group’s preferences is through a survey method called Discrete Choice Experiment (DCE). A DCE presents participants with a series of choices between two different configurations of services, in this case configurations of financial incentive schemes. Using regression modelling, the relative importance of the different domains (or attributes) of the programme can be estimated. This information can be used to decide on the optimal configuration of the financial incentive scheme. Purnell et al. (2014) first suggested the usefulness of DCEs to design financial incentives, and this approach has since been adopted by others (Wright et al. 2019, Becker et al. 2018, Marti et al. 2017, Farooqui et al. 2014, Giles et al. 2016, Hashemi et al. 2015).

A DCE was conducted to elicit men’s preferences for the three domains for which there was most uncertainty: magnitude, frequency and schedule. The attributes and the levels of the DCE were:

-

Value of the incentive at 3 months: £0; £75; £100; £150.

-

Value of the incentive at 6 months: £0; £75; £100; £150.

-

Value of the incentive at 12 months: £100; £150; £200; £250.

The overall magnitude could therefore range from £100 to £550. The incentive at 12 months was always £100 or more to encourage weight loss maintenance.

In each choice, respondents were asked which programme (the intervention), if any, they would choose. The hypothetical endowment and what they would receive as part of the weight loss programme (paid out at 12 months) was explained. To explore whether preferences may vary according to the weight loss target, respondents were randomised to two different sets of weight loss targets (5% and 10%). It was explained that they could choose to receive the incentive as either money or a donation to charity (a separate question asked which option they preferred). An example of choice is presented below. Respondents were presented with 9 choices in total (see supplementary material). Choice 3 was repeated as choice 8 to test for consistency of responses.

Individuals may realise that maintenance of weight loss is challenging and therefore might prefer longer term incentives over short term incentives. This would mean that the amount at 12 months may be valued higher than the amount at 3 months. Individuals may prefer increasing amounts over the three time points or prefer to spread the amount equally over the three time points. In terms of overall amount, a rational individual should prefer the programme with the highest overall amount. However, this may not be the case if the individual has ethical concerns around financial incentives and may find certain higher levels unacceptable.

We used latent class modelling to analyse data, as we expected the sample to have diverging preferences for the weight loss programmes, with some respondents being strongly opposed or in favour of incentives. A model with 3 latent classes was the preferred model (see supplementary material). To assess the relative ranking of different incentive designs for the latent classes we predicted uptake of different weight loss programmes (different incentive designs) as the probability of accepting this alternative (Groothuis-Oudshoorn et al. 2014).

The survey also included questions on other aspects of the financial incentive design, including preferences for donation or money and preferred format of the pledge (cheque, bank statement or facsimile notes). Think aloud individual audio-recorded interviews with PPI contributors (n = 10.) were used to refine the wording to improve understanding of the survey questions.

Sample

Survey data were collected online by Ipsos MORI from 1045 UK men aged 18–75 (with quotas for age and regions). Men were eligible if their reported height and weight placed them in the obese BMI category (BMI ≥ 30 kg/m2). The sample included men from a range of socio-economic backgrounds in order to assess whether preferences vary according to socio-economic status. A pilot of the survey with 106 participants was run by Ipsos MORI prior to the full launch. Ethics approval was obtained from the University of Stirling Research Ethics committee. Data were collected in 2016.

Survey results

A sample of 1045 men with obesity completed the survey, and their characteristics are described in Table 2 (additional characteristics are described in the supplementary material). The average BMI was 34.9 kg/m2.

The DCE responses for the two repeated choices show that 83% of respondents passed the consistency check (they gave the same answer in the choice that was repeated). The opt-out (no weight loss programme) was chosen in only 7% of all choices. Table 3 shows the latent class results (the supplementary material shows the full model which also includes class membership). Of the responses 6.0% were allocated to latent class 1 (‘no incentive’), 29.6% to latent class 2 (‘long term incentives’) and 64.4% of responses to latent class 3 (‘incentives at all time points’). For ‘no incentive’ (latent class 1), the coefficient for alternative A&B (the weight loss programmes) is negative and the amounts are statistically insignificant. This indicates that incentives are not being valued. For ‘long term incentives’ (latent class 2), only the incentives at 6 months and 12 months are significant, suggesting that this class prefers longer-term incentives. The incentive at 12 months is valued relatively more highly than the incentive at 6 months. For ‘incentives at all time points’ (latent class 3), all three incentives are important with the shorter-term incentives being relatively more important. The incentive at 6 months was valued most highly, followed by 3 months and 12 months. We did not find evidence that preferences varied by weight loss target or by socio-economic status (see supplementary material).

The DCE results can be used to understand the preferred configuration (Frequency and Schedule). Appendix 1 shows the ranking of the different configurations of the financial incentive scheme (the choices offered within DCE) in terms of the men’s preferences. For a magnitude of £400, a configuration of £0 at 3 months, £150 at 6 months and £250 at 12 months was the most preferred for the sample as a whole.

The DCE results can also be used to understand the impact of overall magnitude on uptake. The uptake by magnitude for one particular schedule (10%, 45%, 45%) is shown in Fig. 2. It shows that average uptake is relatively low for magnitudes below £200. This is mainly due to low uptake for class 3. Average uptake continues to increase as a function of magnitude. An average uptake of over 90% is predicted for incentives with an overall magnitude of £400.

The use of hypothetical cheques was perceived as the best way to make the pledge at the start of the intervention most realistic (chosen by 54% of the respondents). The majority of men preferred cash, but some (11.6%) preferred charity donations.

V. Stakeholder workshop to reach consensus on final design

The design choices and the DCE findings were then presented for discussion in a stakeholder workshop to reach consensus for the final incentive design. This took place in October 2016. Workshop attendees included a senior Public Health Manager, study co-investigators and researchers (n = 10), dietitians (n = 3) and independent academics (n = 5) with a range of expertise in weight management, public health and financial incentives. PPI representatives attending the event included Men’s Health Forum co-investigators (n = 2), men from the target group (n = 4) and community workers experienced at engaging men from disadvantaged areas (n = 2).

At the stakeholder workshop, men from the target group described a common problem of successfully losing weight and then subsequently putting the weight back on. Ensuring that the incentive strategy supported behaviour change and weight loss maintenance was highlighted as being very important by several participants. Views about the incentive strategy at 3 months were mixed, with some suggesting an incentive for turning up to reinforce the value of early engagement in the programme. Others preferred the incentive to be given only for clinically significant weight loss of 3%, while others preferred incentives for 5% weight loss because early weight loss is the easiest to achieve. The following distribution was selected: £50 at 3 months for 5% weight loss, £150 at 6 months for 10% weight loss and £200 at 12 months for 10% weight loss. The DCE results predict that 91.3% of the target population will take up the programme with this incentive configuration. Whilst the configuration of £0 at 3 months, £150 at 6 months and £250 at 12 months was associated with a slightly higher average uptake, having an incentive at 3 months was considered to be important by stakeholders in terms of early engagement. The distribution of targets, specifically losing 10% gradually over 6 months and then maintaining weight loss, was recognised as challenging. Stakeholders were concerned that narrowly missing the 10% target could be distressing and potentially demotivating, given the fluctuations in weight over 24 hours. The incentive scheme was therefore modified by allowing individuals to secure part of the money if they lost between 5 and 10% at 6 and 12 months.

In the final agreed intervention, participants were ‘endowed’ with a total of £400 incentive at baseline which was placed into a hypothetical personal account at the University of Stirling and given a mock-up personalised cheque (see supplementary material). The full £400 could be secured by meeting weight loss targets at researcher assessments: 5% of body weight lost since baseline at 3 months (£50 secured/lost), 10% lost since baseline at 6 months (£150 secured/lost) and 10% lost since baseline at 12 months (£200 secured/lost) (supplementary material). Weight loss was verified at all face-to-face appointments. At 6 and 12 months, men lost a proportion of the money for each % weight loss not attained between 5 and 10%. Verified weight at 12 months (following a protocol) had to be less than at baseline to receive any money, regardless of whether interim weight loss targets had been met. Men received the money by direct bank transfer after the 12-month assessment. The incentive scheme was explained in a leaflet which men received after randomisation (see supplementary material). At this point they were informed that they could keep the money or donate the money to charity. Feedback on meeting incentive targets was sent by automated text message and displayed on a personalised webpage.

Experiences of men with the financial incentives scheme

To test the acceptability and feasibility of the scheme in real time, 105 men with obesity were randomised to receive financial incentives and narrative text messages, narrative text messages only, or a waiting list for text messages. Ethics approval was obtained from the University of Stirling Research Ethics committee. Acceptability and feasibility of delivering the incentive scheme and trial recruitment, retention and data collection are reported elsewhere (Dombrowski et al. 2020). The paper here focuses on the men who were randomised to receive financial incentives (alongside the supportive text messages). At 3 months, 26 qualitative interviews were conducted to assess overall acceptability of the interventions (including the incentives). After the 12-month assessment, more in-depth qualitative interviews were conducted with 14 participants from diverse backgrounds. Analysis followed the framework approach (Ritchie and Spencer 2002) using QSR NVivo (v12) to manage data indexing and coding. The qualitative interviews enabled us to explore how the design choices, including framing of the incentives in terms of hypothetical losses, were understood and the overall acceptability of the incentive intervention.

Understanding loss aversion

The financial incentive scheme tried to invoke loss aversion by endowing individuals with a hypothetical total amount (£400) at the start, which they could either secure or lose depending on whether weight loss targets were met. However, the extent to which participants understood the incentives in this way is uncertain. Some appeared to describe the incentives as being a reward assigned after successful weight loss. Others seemingly gave little thought to the £400 in-between weight assessments and some doubted ‘it was actually real money and it wasn’t tokens [laugh]’ until the 12 month appointment. Rather than starting out with money that reduced if targets were not met, many appeared to think that the money was ‘earned’ over time according to weight loss, as the following illustrates:

Yeah after 3 months I'm thinking ‘okay that money is in the bank’, after 6 months ‘yeah that money’s in the bank’ but I wasn’t really conscious of the fact that there was money there waiting for you. (220050, 12m)

Others clearly understood the loss aversion concept and embodied this theory in their weight loss endeavours. They spoke about watching the £400 sum ‘dwindle away’ if targets were unmet. One participant explained how they were driven by wanting to avoid failure, and loss aversion married well with this attitude.

It [the money] helps yeah, it helps. I mean, it’s a shame to lose it, especially having gone through the first part and being really successful, I think that was a good motivator to keep going to say that you’ve got this but it can dwindle away again, not I can lose what I had but whatever you can continue to achieve would dwindle based on failing, so the more you fail the more you lose. (120031, 12m)

Participants made suggestions as how to improve the communication of the incentive scheme including the concept of losses.

The only way, particularly if it was going to be rolled [out] on a larger scale, where there would be potentially budget for a resource that would include something like an introduction video … where it could be made very clear by an animation, you know? So there’s a pile of coins … and then you don’t …. and then some of that disappears, you know, so something like that. (220045, 12m)

Effectiveness of the cheque

Views were also elicited on the effectiveness of the mock-up personalised cheque presented to participants at the start. Several participants viewed the cheque as positive.

Yeah, you get that kinda stuff in the supermarket all the time and you can’t cash it, but it was a nice wee additive to the wee pack. (220045, 12m)

For other participants the cheque did not reduce their suspicions around whether they would receive actual money.

But the original content what it was, was ‘aye okay, you’re going to give me £400 to lose all this weight, aye that’ll be right! (210023, 12m)

Timing and magnitude of the incentive

Some participants indicated that the gap between the 6-month and 12-month weight assessment was too long and that more regular assessments would be useful. However, these additional ‘weigh-ins’ should not necessarily be incentivised.

It seems to be a long time between the 6 months to the year, I feel there maybe should be even a check in, aye, no money, just a wee check in how you’re getting on at maybe the nine months. (120017, 12m)

Participants’ views varied on the overall magnitude of £400. For some it was not a lot of money, by referring to it ‘a wee sugary incentive’. Others considered it appropriate and equated it to the magnitude of effort required, and thought it was sufficient to motivate when compared to smaller incentives.

I think if the total incentive had been £40 or £50 then that would’ve been less so, quite obviously, but how much more of an incentive would it have been if it was £600, not half as much again, you know, so I think the kinda pitch point for that part of it was perfect.(220040, 3m).

Some men displayed a certain degree of discomfort at the idea of being rewarded for reversing ‘bad behaviour’ and for them altruism came to the fore, stating their intention to donate some or all of the money to charity.

So money wise it wasn’t a concern for me, as I says, all I’ll do with that money, that’ll go to Cat and Dog Home and the Guide Dogs for the Blind, money’s not a concern, money like that is a kinda drop in the ocean. (210016, 12m)

However, for others receipt of the money was welcomed, where for instance, buying new clothes were a necessity subsequent to substantial weight loss. When asked what he would spend the money on, one participant stated:

It’s spent [laugh], well I had a buy a suit, I bought some trousers but I’ve not been really buying, like, I’ve been buying ones in the sales. (110014, 12m)

Fieldworkers detected non-verbal discomfort and embarrassment when initially discussing charitable donations with some men. Therefore charitable donations were removed from later study information materials and interview topic guides. Men therefore had full autonomy over what to do with their money and any perceived moral imperative to behave altruistically was removed.

Discussion

This paper describes an inclusive approach to designing financial incentives for health behaviour change for weight loss by including perspectives of the target population and service providers. Describing how the chosen incentive structure was developed is important to understand and improve the incentive intervention development process (Duncan et al. 2020). To design financial incentives for weight loss in men with obesity living in areas with high levels of disadvantage, we first used the Adams et al. (2014) framework to identify all domains for which choices need to be made. These choices were made on the criteria of effectiveness, uptake, sustainability and acceptability. Stakeholders were involved throughout and preferences of the target population were elicited using a DCE. A stakeholder workshop was used to decide on the final design. The final incentive design was tested in a feasibility trial (Dombrowski et al. 2020) which showed promise, and a full definitive trial is in progress (Macaulay et al. 2022). Three minor modifications were required, which endorse our approach to incentive design as fit for the purpose of effectiveness evaluation. Firstly, all mention of charity donations was removed from information materials; secondly, the incentive provider named on the mock cheque was changed from University of Stirling to Game of Stones Research, as the intervention will be tested across the UK and men in other parts of the UK are likely to be unfamiliar with the University of Stirling; and, thirdly, an online audio-visual explanation of the incentive scheme was developed, in addition to the written participant information leaflet (see supplementary material).

The results from the DCE showed that the incentive at 6 months, and, for part of the sample, also the incentive at 12 months, were more important than the incentive at 3 months. The only comparable study is a DCE which elicited preferences for a weight loss programme in a sample of US adults (Hashemi et al. 2015). The attributes in their DCE were size, form and timing of the incentives. They found that individuals prefer more immediate incentives. There are a number of reasons why the results of the two studies may differ. The incentives were framed as losses in our study, whilst Hashemi et al. (2015) used gains. The samples also differed, namely men with obesity in the UK versus a general population in Virginia US, which included both normal and overweight individuals.

The developed incentive scheme is relatively novel as it mimics deposit contracts, but incurred hypothetical rather than real losses in recognition of the needs of those living in areas of higher deprivation. A hypothetical cheque is provided to make the money seem ‘real’ for participants – a precondition for loss aversion effects to influence weight loss motivation and efforts. There was mixed evidence in the feasibility study as to whether this was achieved. Whilst the qualitative data suggest that for some men the concept of the potential for losses was clearly understood, for others this was not always fully understood. The new online audio–visual explanation of the incentive scheme in the full trial is expected to improve this.

The DCE confirmed that there was considerable heterogeneity in preferences for the value and timing of the financial incentives. Preferences ranged from incentives not being valued at all, to only the longer-term incentives being valued, and all incentives being valued. Whilst the incentive design with the highest predicted average uptake would generally be the preferred choice, uptake could be improved by giving individuals a choice of incentive schemes so that they can choose the scheme most closely aligned with their preferences. This would be an interesting area for future research.

There are a number of limitations to our approach. The DCE predicted very high levels of uptake for part of the sample. This could be caused by hypothetical bias where the choices individuals make in a DCE do not accurately reflect the choices individuals make in real life (Quaife et al. 2018). Ipsos Mori pay participants to complete surveys and online panel members may therefore be more likely to prefer incentives and less likely to opt out. Social desirability bias may have also influenced responses in both the DCE and the qualitative research, especially around issues such as charity donation and size of incentives. The incentive structure was kept relatively simple. Future research could explore extensions such as adding a bonus system for weight loss higher than 10%.

This paper demonstrates that a mixed methods approach with stakeholder involvement can be used to design financial incentives for health behaviour change such as weight loss. We hope it encourages researchers and others tasked with developing incentive schemes to consider all domains in which incentives may vary and to report the design process transparently.

Data availability

Data are available on reasonable request. Access to data can be arranged through the coprincipal investigators of the study: Professor Pat Hoddinott (University of Stirling, p.m.hoddinott@stir.ac.uk) and Dr. Stephan Dombrowski (University of New Brunswick, stephan.dombrowski@unb.ca) to discuss data sharing, data requirements and conflicts of interest, in line with any EU and other regulations, including ethics approvals.

References

Adams J, Giles EL, McColl E et al (2014) Carrots, sticks and health behaviours: a framework for documenting the complexity of financial incentive interventions to change health behaviours. Health Psychol Rev 8(3):286–295. https://doi.org/10.1080/17437199.2013.848410

Becker F, Anokye N, De Bekker-Grob EW et al (2018) Women’s preferences for alternative financial incentive schemes for breastfeeding: A discrete choice experiment. PLoS One 13(4). https://doi.org/10.1371/journal.pone.0194231

Coupe N, Peters S, Rhodes S et al (2019) The effect of commitment-making on weight loss and behaviour change in adults with obesity/overweight: a systematic review. BMC Public Health 19(1). https://doi.org/10.1186/s12889-019-7185-3

Dombrowski SU, Knittle K, Avenell A et al (2014) Long term maintenance of weight loss with non-surgical interventions in obese adults: Systematic review and meta-analyses of randomised controlled trials. BMJ (Online) 348. https://doi.org/10.1136/bmj.g2646

Dombrowski S, McDonald M, van der Pol M et al (2020) Game of stones: feasibility randomised controlled trial of how to engage men with obesity in text message and incentive interventions for weight loss. BMJ Open 10(2):e032653. https://doi.org/10.1136/bmjopen-2019-032653

Duncan E, O'Cathain A, Rousseau N et al (2020) Guidance for reporting intervention development studies in health research (GUIDED): an evidence-based consensus study. BMJ Open 10(4):e033516. https://doi.org/10.1136/bmjopen-2019-033516

Farooqui MA, Tan Y, Bilger M et al (2014) Effects of financial incentives on motivating physical activity among older adults: Results from a discrete choice experiment. BMC Public Health 14(1). https://doi.org/10.1186/1471-2458-14-141

Giles EL, Becker F, Ternent L et al (2016) Acceptability of financial incentives for health behaviours: A discrete choice experiment. PLoS One 11(6). https://doi.org/10.1371/journal.pone.0157403

Groothuis-Oudshoorn CG, Fermont JM, Van Til JA et al (2014) Public stated preferences and predicted uptake for genome-based colorectal cancer screening. BMC Med Informatics Decis Mak 14(1). https://doi.org/10.1186/1472-6947-14-18

Halpern SD, French B, Small DS et al (2016) Heterogeneity in the effects of reward- and deposit-based financial incentives on smoking cessation. Am J Respir Crit Care Med 194(8):981–988. https://doi.org/10.1164/rccm.201601-0108OC

Hashemi A, You W, Boyle K et al (2015) Identifying financial incentive designs to enhance participation in weight loss programs. J Obes Weight Loss Ther 5:247

Jeffery RW (2012) Financial incentives and weight control. Prev Med 55(Suppl):S61–S67. https://doi.org/10.1016/j.ypmed.2011.12.024

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–292

Lorenc T, Petticrew M, Welch V et al (2013) What types of interventions generate inequalities? Evidence from systematic reviews. J Epidemiol Community Health 67(2):190–193. https://doi.org/10.1136/jech-2012-201257

Macaulay L, O’Dolan C, Avenell A et al (2022) Effectiveness and cost-effectiveness of text messages with or without endowment incentives for weight management in men with obesity (game of stones): study protocol for a randomised controlled trial. Trials 23(1):582. https://doi.org/10.1186/s13063-022-06504-5

Mantzari E, Vogt F, Shemilt I et al (2015) Personal financial incentives for changing habitual health-related behaviors: a systematic review and meta-analysis. Prev Med 75:75–85. https://doi.org/10.1016/j.ypmed.2015.03.001

Marti J, Bachhuber M, Feingold J et al (2017) Financial incentives to discontinue long-term benzodiazepine use: A discrete choice experiment investigating patient preferences and willingness to participate. BMJ Open 7(10). https://doi.org/10.1136/bmjopen-2017-016229

Mitchell MS, Orstad SL, Biswas A et al (2019) Financial incentives for physical activity in adults: systematic review and meta-analysis. Br J Sports Med. https://doi.org/10.1136/bjsports-2019-100633

National Institute for Health and Care Excellence (NICE) (2014) Behaviour change: individual approaches

O'Cathain A, Croot L, Duncan E et al (2019) Guidance on how to develop complex interventions to improve health and healthcare. BMJ Open 9(8). https://doi.org/10.1136/bmjopen-2019-029954

Patel MS, Asch MDDA, Rosin R et al (2016) Framing financial incentives to increase physical activity among overweight and obese adults a randomized, controlled trial. Ann Intern Med 164(6):385–394. https://doi.org/10.7326/M15-1635

Paul-Ebhohimhen V, Avenell A (2008) Systematic review of the use of financial incentives in treatments for obesity and overweight. Obes Rev 9(4):355–367. https://doi.org/10.1111/j.1467-789X.2007.00409.x

Promberger M, Dolan P, Marteau TM (2012) "pay them if it works": discrete choice experiments on the acceptability of financial incentives to change health related behaviour. Soc Sci Med 75(12):2509–2514. https://doi.org/10.1016/j.socscimed.2012.09.033

Purnell JQ, Gernes R, Stein R, Sherraden MS, Knoblock-Hahn A (2014) A systematic review of financial incentives for dietary behavior change. J Acad Nutr Diet 114(7):1023–1035. https://doi.org/10.1016/j.jand.2014.03.011

Quaife M, Terris-Prestholt F, Di Tanna GL et al (2018) How well do discrete choice experiments predict health choices? A systematic review and meta-analysis of external validity. Eur J Health Econ 19(8):1053–1066. https://doi.org/10.1007/s10198-018-0954-6

Ritchie J, Spencer L (2002) Qualitative data analysis for applied policy research. . In: Huberman A, Miles M (eds) Sage publications, p 305–332

Robertson C, Archibald D, Avenell A et al (2014) Systematic reviews of and integrated report on the quantitative, qualitative and economic evidence base for the management of obesity in men. Health Technol Assess 18(35):1–424. https://doi.org/10.3310/hta18350

Rousseau N, Turner KM, Duncan E et al (2019) Attending to design when developing complex health interventions: a qualitative interview study with intervention developers and associated stakeholders. PLoS One 14(10). https://doi.org/10.1371/journal.pone.0223615

Turner KM, Rousseau N, Croot L et al (2019) Understanding successful development of complex health and healthcare interventions and its drivers from the perspective of developers and wider stakeholders: an international qualitative interview study. BMJ Open 9(5). https://doi.org/10.1136/bmjopen-2018-028756

Vlaev I, King D, Darzi A et al (2019) Changing health behaviors using financial incentives: a review from behavioral economics. BMC Public Health 19(1):1059. https://doi.org/10.1186/s12889-019-7407-8

Volpp KG, Pauly MV, Loewenstein G et al (2009) Market watch. P4P4P: an agenda for research on pay-for-performance for patients. Health Aff 28(1):206–214. https://doi.org/10.1377/hlthaff.28.1.206

Wright DR, Saelens BE, Fontes A et al (2019) Assessment of Parents' preferences for incentives to promote engagement in family-based childhood obesity treatment. JAMA Netw Open 2(3):e191490. https://doi.org/10.1001/jamanetworkopen.2019.1490

Yancy WS, Shaw PA, Wesby L et al (2018) Financial incentive strategies for maintenance of weight loss: results from an internet-based randomized controlled trial. Nutr Diabetes 8(1). https://doi.org/10.1038/s41387-018-0036-y

Acknowledgements

We would like to thank Nicolas Krucien for advice on the DCE design and analysis. This project was funded by the National Institute for Health Research [Public Health Research] (project number 14/185/09). The Chief Scientist Office of the Scottish Government Health and Social Care Directorates funds HERU and NMAHP-RU. The views and opinions expressed therein are those of the authors and do not necessarily reflect those of Public Health Research, NIHR, NHS, the Department of Health or CSO. The Health Informatics Centre, University of Dundee provided the automated software for intervention delivery. We would like to thank all the men, Game of Stones research team and stakeholders who gave generously of their time.

Funding

This project was funded by the National Institute for Health Research [Public Health Research] (project number 14/185/09).

Author information

Authors and Affiliations

Consortia

Contributions

Stephan U Dombrowski led the overall study with Pat Hoddinott as joint chief investigator and co-led the design and overall conduct of the study. Marjon van der Pol was a coinvestigator, contributed to the design and the interpretation of findings and led the DCE and health economic analysis. Hannah Collacott undertook the recruitment and data collection for the DCE. Matthew McDonald undertook the study set up, recruitment and data collection for the feasibility study and coordinated various PPI activities and contributed substantially to qualitative and quantitative data analysis and interpretation. Alison Avenell, Cindy Gray and Frank Kee were coinvestigators and contributed to the design and the interpretation of findings. Fiona Harris was a coinvestigator, oversaw the qualitative data collection and analysis and contributed to the interpretation of findings. Rebecca Skinner contributed to recruitment, data collection and undertaking qualitative interviews for the feasibility study and contributed to the interpretation of findings. The first draft of the manuscript was written by Marjon van der Pol and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

Ethics approval was obtained for the incentive design phase from the University of Stirling Psychology Ethics Committee on 8 January 2016. Ethics approval was obtained for the feasibility study from the North of Scotland Research Ethics Service on 7 December 2016 (reference 16/NS/0120).

Consent to participate

Informed consent to participate in the study was taken.

Consent for publication

Not applicable.

Conflict of interest

The authors declare that they have no conflicts of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(DOCX 1935 kb)

Appendix 1

Appendix 1

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van der Pol, M., McDonald, M., Collacott, H. et al. Designing financial incentives for health behaviour change: a mixed-methods case study of weight loss in men with obesity. J Public Health (Berl.) 32, 65–77 (2024). https://doi.org/10.1007/s10389-022-01785-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10389-022-01785-1